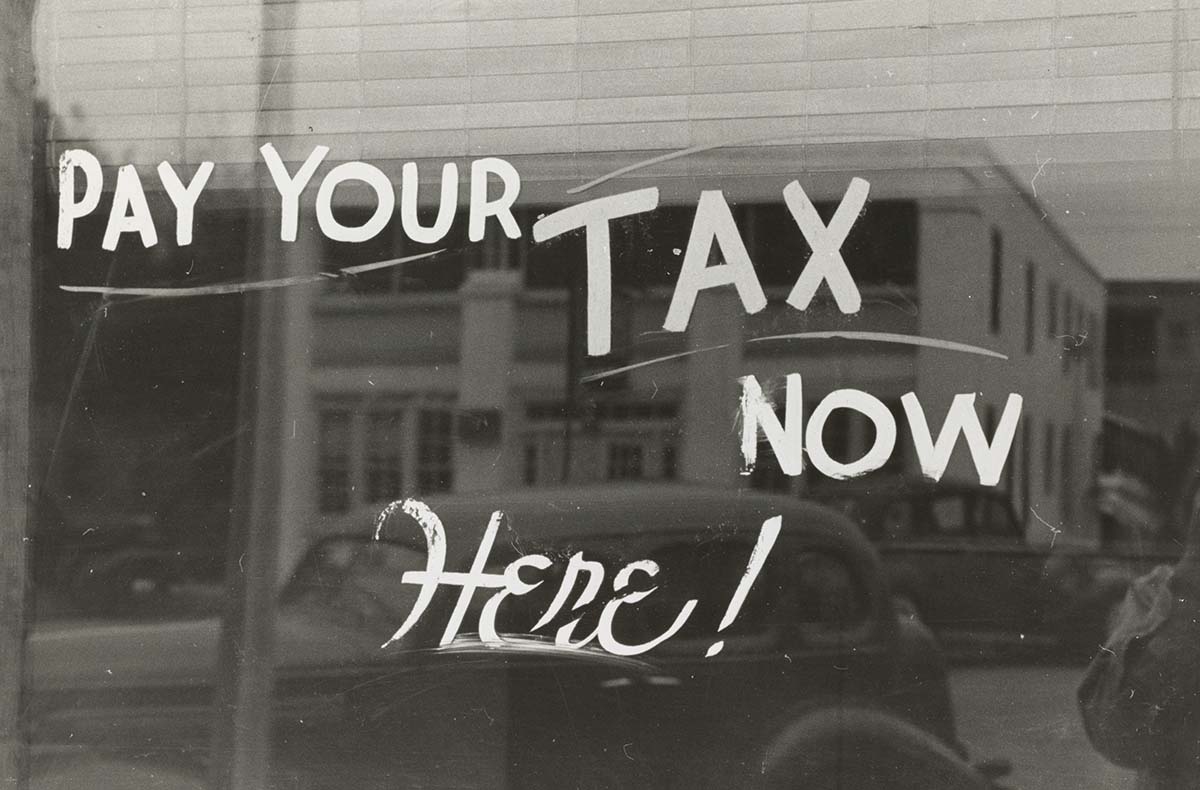

A free national tax filing system proposed by the IRS and intended to begin next year is getting severe pushback from Congress and lobbying groups with millions in support from tax preparation firms. At the same time, citizen groups around the country fight for its implementation.

I know the need for this firsthand.

Growing up in an immigrant household in the epicenter of OakCliff, a section of Dallas, I quickly learned the unspoken struggles low-to-moderate-income families face when trying to find resources available to them for free, and in their language.

From an early age, I saw my mom and dad stretch every dollar that came into the household. But the true struggle began with knowing and understanding where to find the resources that could have helped us get out of the harsh cycle of living paycheck to paycheck.

Throughout my six years working for the Dallas Community Tax Centers, I have seen the exploitation of low-to-moderate-income households by predatory tax preparers. I deeply understand that the road to financial wellness, freedom, and security can begin with a simple tax return.

To provide protection to vulnerable families and promote a just tax environment, Texas must draw inspiration from the success of Albuquerque, New Mexico, and enact similar state ordinances to regulate tax preparers and enhance free tax preparation programs.

According to the U.S. Census Bureau, in 2020, 37.2 million Americans were living in poverty, an increase of 3.3 million over 2019. With low income defined as $30,000 per year for a family of four, 8.1 percent of the population in 2020 earned between $25,000 to $34,999.

For a significant number of low-income Americans, tax season signifies the largest single infusion of money throughout the year. Some families rely on the golden moment where they are given their refund amount to stay afloat, and pay past debts and utilities to live a normal life.

Although this moment has so much power to change the course of a family’s financial future, it can often be eclipsed by the high cost of tax preparation fees. Families in desperate need of their refund often gravitate towards locations found on every street corner, or makeshift offices inside the homes of individuals who have been referred by an acquaintance due to their ability to get a guaranteed high refund.

Paid preparers often charge between $200-$1,000 for tax preparation. Most of the time, these fees are hidden and taken out of the total refund amount.

Recent data shows that last year, Texas ranked fourth in the country for the number of taxpayers who paid tax preparation fees. According to the Consumer Financial Protection Bureau, New York ranked first.

In the 2020 tax year, over 48% of those eligible to file their tax return at a free tax preparation site paid a preparer to have their taxes filed.

In addition, over 18 million more people filed their taxes with a paid preparer and then had a Refund Anticipation Check (RAC). In total, eligible Texan filers paid over $2.72 billion in tax preparation fees and RAC fees.

Most families don’t know that just about anyone can be a tax preparer, and there is little to no regulation set to test preparers on their knowledge of current tax law, or even a code of ethics to follow.

In a past audit, the Government Accountability Office discovered that 60% of returns prepared by paid preparers contained errors, such as inflated deductions and misrepresentation of tax credits.

The consequences of these significant errors often fall on the taxpayer, including audits, repayment, penalties, and interest owed to the IRS. Additionally, families can be barred from claiming the EITC credit if an error is found on their tax return. Meanwhile, the preparers often disappear into the night only to set up shop in a different neighborhood the following year.

In 2011, the Barack Obama administration tried and failed to introduce regulations that required tax preparers to pass a basic competency test and background checks, pay an annual registration fee, and stay updated on tax regulations via ongoing education.

A panel of Republican-appointed judges sided with the Institute for Justice, a group partly funded by the Koch brothers, and found that paid tax preparers are not “representatives of person” and therefore did not need to be regulated.

With several federal efforts to regulate swindling tax preparers, one must look at alternative solutions that can be enacted more swiftly. The Albuquerque city ordinance enacted in 2021 serves as a model for reform.

This ordinance is a response to the urgent need to address the exploitative practices of predatory tax preparers. It successfully puts a check on these harmful practices while prioritizing the interests of low to moderate-income families.

By mandating tax preparers to disclose pricing, guaranteeing competent and ethical services, and offering consumer recourse for issues, the ordinance has significantly reduced the financial burden that many families face during tax season. Additionally, paid preparers must now disclose a family’s qualification for free tax preparation services offered by a local Volunteer Income Tax Assistance program.

The IRS launched the VITA program in 1969 as a way to give free tax help to individuals and families who earn less than $60,000. The VITA program aims to ensure clients receive all of the tax credits and deductions that they are entitled to, without having to pay a fee to file.

In Texas, VITA programs are responsible for filing more than 119,000 tax returns, resulting in over $38 million in tax preparation fees saved. Although this is a large endeavor, less than half of those who truly qualify are aware that they can seek this free service.

VITA programs empower individuals to make informed decisions and break the cycle of financial instability. These programs go beyond tax preparation; they also serve as a catalyst for financial education and empowerment within the communities that they serve. Through one-on-one interactions, volunteers are able to impart financial literacy knowledge and awareness, helping families develop budgeting skills, savings strategies, and long-term financial planning.

Access to free tax preparation resources through VITA programs is the cornerstone of financial wellness for low-to-moderate-income families.

As the IRS’s effort to introduce an accessible free file program meets with resistance and political challenges, in order to provide protection to vulnerable families and promote a just tax environment now, Texas—and every state in the union—must draw inspiration from the success of Albuquerque and enact similar local and state ordinances to regulate tax preparers and enhance free tax preparation programs.

Through increased funding, partnerships with community organizations, and greater public awareness, it is possible to ensure that these vital resources are available to those who need them most.