One of the inherent risks of owning stock is that the price can close at one price and open at a dramatically different price the next day. This is what’s called a “gap.” The potential for price gaps can make it difficult for the shareholder to get out at the price they want. In fact, the use of stop-loss orders can even exacerbate the potential loss when price gaps occur.

However, there is a way to guarantee your ability to sell a stock at a set price through a strategy called a “married put.” This is an important strategy to deploy before corporate earnings and other volatile events, which can help you lock in your gains and reduce risk. This process of understanding how to hedge risk using specific criteria is something we emphasize at TheoTrade, where I serve as Chief Market Strategist, and is something any savvy investor would be wise to consider.

Stop Losses and Gap Risk

A stop-loss order is an order that is placed to sell a stock at a market or limit. Your stop is triggered when the stock price falls below your stop price. At that point, a market or limit order is sent off to sell your stock based on the conditions of the order. In the case of a market order, you’re telling the exchange to immediately sell your stock at the best available price. In the case of a limit order, you’re saying that you’ll only sell at your limit price or above. That means a stop market order will guarantee you’re out of your stock, but you have no control over the price it sells. For stop-limit orders, you control the price but are not guaranteed that your sell order is filled.

This means that stop-loss orders are poor protection against overnight price gaps in a stock and even during fast market conditions. Bad news, poor earnings, political problems, and many other factors can cause a stock to gap down overnight.

Let’s look at an example:

XYZ biotech stock gaps down from $31 to $20 overnight because of an important drug failing to gain FDA approval. If you had placed a stop-loss at $30, the stop would trigger since the price fell below $30, but the sale price would be around $20. This happens because the price fell below the trigger (stop) at $30, but the first available price to sell is when the stock opened $20.

If you had used a stop-limit order, your stop would have been triggered as the price falls below $30, but the stock would not be sold. This happens when you set your limit order at $30, and the stock is trading at $20. The limit could eventually close you out, but only if the price rallies back to $30, which may never happen. You’re essentially stuck with the $10 loss and holding the stock.

Another risk of using stop losses is that you may end up selling at inopportune times. For example, the price falls to your $30 stop and then rallies higher. In this case, the stock only briefly trades at $30, taking you out of stock. This can be frustrating when you have bullish expectations that are realized, but your stop sold the stock prematurely. It’s these types of limitations that have some exchanges to consider not accepting stop orders.

So, if stops can force you to sell at inopportune times, miss the move, and can’t protect you when the stock price gaps, what good are they? If you find yourself asking this question, you’re on the right track!

Guarantee Your Exit Price with Married Puts

A married put strategy is where the investor owns shares of stock and a put together. The idea of marrying the stock and the put is to remove gap risks by allowing the stockholder to guarantee the sale price through the purchase of a put option on the stock.

A put option gives you the right to sell 100 shares of the stock at a set price for a period of time. You can choose the expiration and the strike price that you wish to sell your stock for a premium that is paid for the option. Owning the puts allows the holder to ride out these downturns since the value of the put is offsetting the loss on the stock. That means that the risk of a price gap is removed since you purchased the right to sell your shares of stock at a higher price!

Let’s look at the options of the married put holder when there is a price gap.

- You can exercise your right to sell the stock at the put strike price.

- You can sell the put option and keep the stock and then re-hedge the position with another put. You will then own the stock at the current price, but the sale of the put option will give you the difference between the put strike price and the current price of the stock, plus any remaining time value in the put.

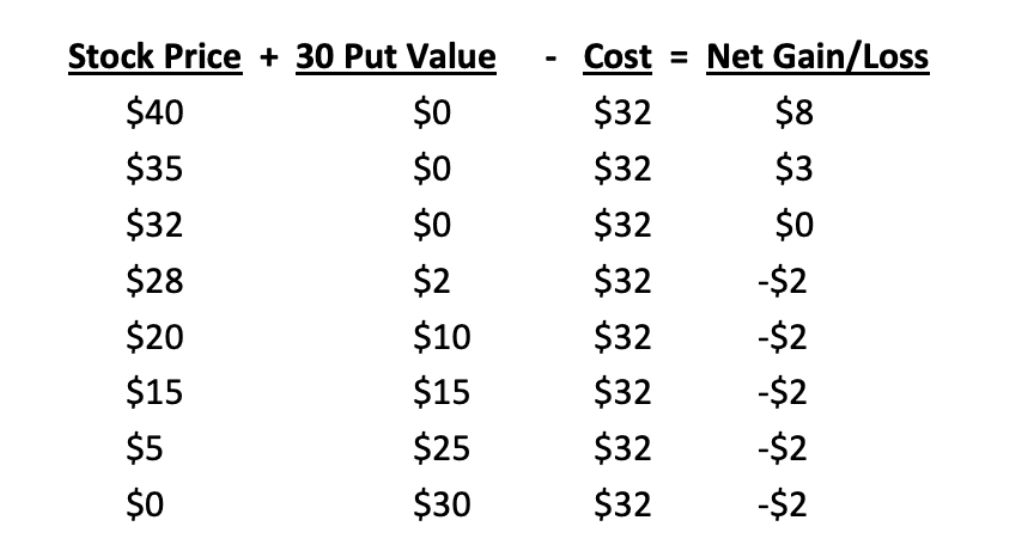

The following table will show you the value of the put option at expiration based on various stock prices. The profit or loss on XYZ stock assumes you bought the stock for $31 and a married put at the $30 strike price for $1. Therefore, the total investment is $32.

Notice that if you keep the stock and hold the put, you will own the stock at the current price and have a put with a minimum value that will help offset your loss. Adding the two together, your net loss in this example will never be more than $2, no matter how low the stock goes!

If your stock continues to decline, you can sell the put and buy a lower strike price put for the next month. This strategy is called “rolling” and allows you to capture most of the premium or profits from the put you purchased and use some of the premium to buy a put at a lower strike price. If the stock rises, you have captured the profit from the put that offset most of the potential loss, and you’re able to recapture the gains on the stock.

It’s reasonable for you to want to control the risk of an investment. While stop-loss orders seem attractive, they don’t provide you with the level of protection that most investors assume. Not only does a stop loss fail to help when the price has an overnight gap, it can take you out of your stock at inopportune times. This can cause you to miss the move and lock in a loss. Using a married put strategy will allow you to lock in your sale price, which can offset much of the loss by guaranteeing your ability to sell your stock at a predetermined price, reducing your risk, and increasing your potential gains.